Introduction to Indian Financial Markets - Part 2

A note on the Indian financial markets structure and key definitions

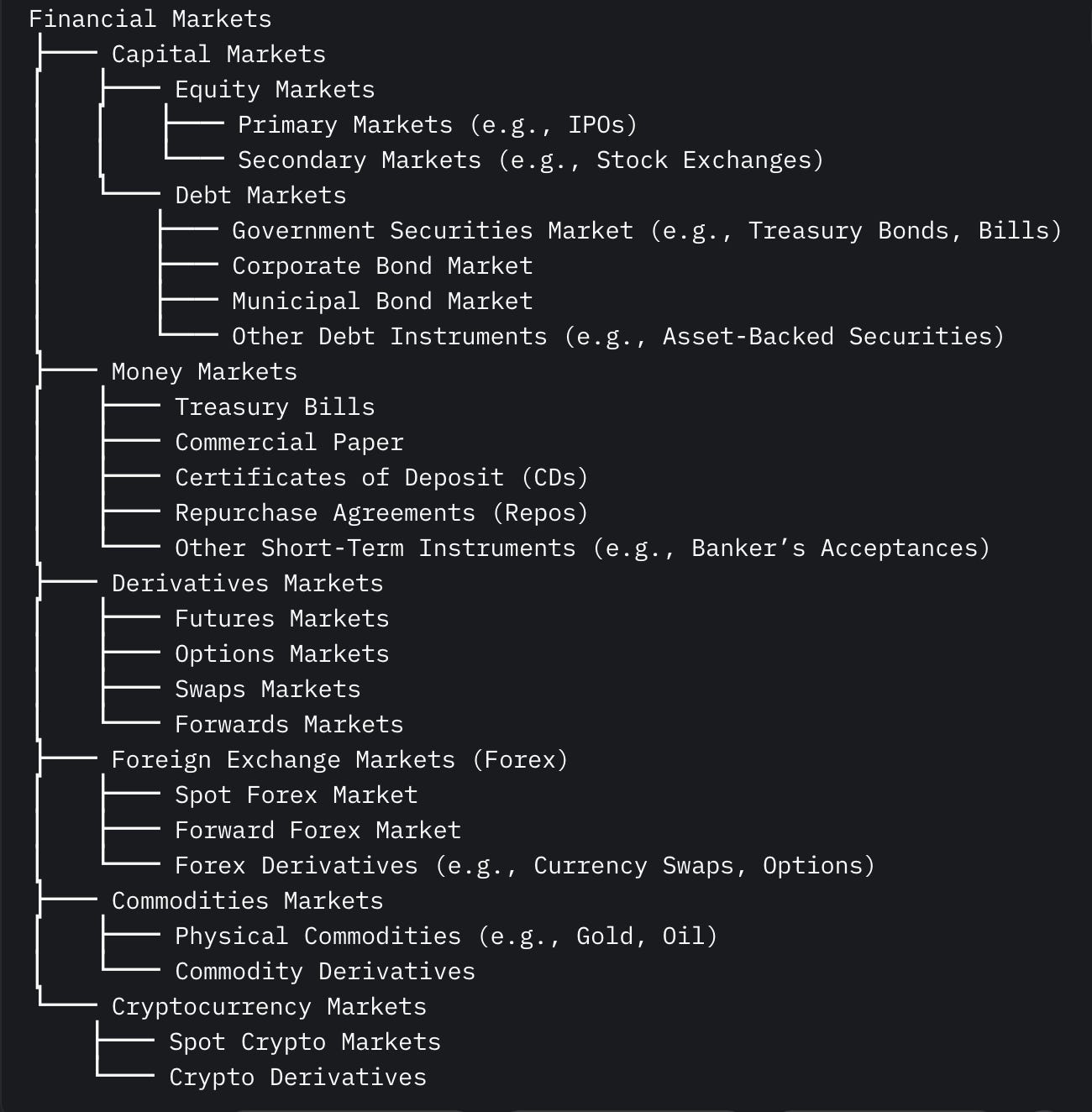

The Indian financial markets is a collective term that consists of many “types” of financial markets each dealing in a particular type of security. The overall hierarchy is laid out in the image below. In this post we will discuss each of the market types in detail to understand the ecosystem holistically.

Markets Hierarchy Explained

Capital Markets

Capital markets are financial markets where long-term funds are raised and invested, primarily involving the trading of equity and debt securities with maturities typically exceeding one year. They serve as a bridge between those who need capital (e.g., corporations, governments) and those who have surplus funds (e.g., investors). Capital markets are divided into two main categories:

Equity markets are a segment of the capital markets where shares of ownership (stocks) in companies are issued and traded. They allow companies to raise capital by selling ownership stakes to investors and provide investors with opportunities to buy, sell, and hold these shares. Equity markets are further divided as follows:

Primary Markets

This is where new stocks are issued and sold for the first time, typically through an Initial Public Offerings (IPOs) or follow-on offerings.

Companies use the proceeds to fund growth, expansion, or other business activities.

Examples include IPOs of companies like Zomato or Paytm.

Secondary Markets

This is where existing stocks are traded among investors after their initial issuance, such as on stock exchanges (e.g., National Stock Exchange, BSE etc) or over-the-counter (OTC) markets.

Prices are determined by supply and demand, influenced by company performance, economic conditions, and investor sentiment.

Examples include daily trading of Reliance or ICICI Bank.

Debt markets are a segment of the capital markets which Involve the issuance and trading of debt securities, such as bonds, where borrowers (e.g., governments, corporations) owe money to lenders (investors). They offer fixed income to investors and allow issuers to fund projects or manage debt. Debt markets are further divided as follows:

Government Securities Market (e.g., Treasury bonds, bills). Both Central and State governments raise loans through bond issuances. When states hit the debt markets, they do so by issuing “State Development Loans”. RBI helps in the issuances on behalf of Central & State governments

Corporate Bond Market (e.g., company-issued bonds).

Other Debt Instruments (e.g., asset-backed securities).

Securities in the debt markets are traded on the platforms explained in this post.

Money Markets

Money markets are financial markets where short-term funds are lent and borrowed, typically with maturities of one year or less. They provide liquidity to financial institutions, governments, and corporations by facilitating the trading of highly liquid, low-risk debt instruments. Money markets are distinct from capital markets due to their short-term nature and focus on preserving capital rather than long-term investments. The money markets in India include:

The Uncollaterised segment - These include call, notice and term money which can be accessed by banks and primary dealers, subject to prudential limits set by the RBI.

Call Money - It is a short-term borrowing/lending scheme (unsecured) between banks and other financial institutions where the term limit is 1 day. This is also called overnight borrowing.

Notice Money - It is a short-term borrowing/lending scheme (unsecured) between banks and other financial institutions where the term limit is from 2 to 14 days.

Term Money - It is a short-term borrowing/lending scheme (unsecured) between banks and other financial institutions where the term limit is from 15 days upto 1 year.

The collateralised segment - These include triparty repo, market repo and repo in corporate bonds which are accessed by banks, primary dealers, mutual funds, insurance companies and corporates

Repo - A repo (or repurchase agreement) is a sale of government securities with an agreement to repurchase the same securities at a specified price at a future date. This is analogous to a secured loan taken by an individual from a bank (putting some collateral in place) with an obligation to repay the loan at the end of the loan term. In a repo, the borrower - usually a large bank - sells it’s government securities from it’s treasury to the RBI (the lender) for an equivalent amount in cash. On the due date, the borrower bank gives the cash back to the RBI and repurchases the securities at a price higher than the cash loan it received. This difference is the repo rate.

Triparty Repo - A Tri-Party repo is a type of repo contract where a third party (apart from the borrower and lender), called a Tri-Party Agent, acts as an intermediary between the two parties to the repo to facilitate services like collateral selection, payment and settlement, custody and management during the life of the transaction. The tri-party repo was introduced to improve liquidity in the bond markets (specifically in the corporate bond markets) to serve as a viable alternate to government securities market and to prevent counterparty default.

Commercial Paper (CP) and Non-Convertible Debenture (original maturity upto one year) – instruments with original maturity up to one year which can be issued by companies, including Non-Banking Finance Companies (NBFCs) and financial institutions.

Certificate of Deposit (CD) – a negotiable, unsecured money market instrument with original maturity up to one year which are issued by banks.

Securities in the money markets are traded on the platforms explained in this post.

Derivatives Markets

Derivatives markets are financial markets where derivative instruments—contracts whose value is derived from an underlying asset (e.g., stocks, bonds, commodities, currencies, or indices)—are traded. These markets allow participants to hedge risks, speculate on price movements, or gain exposure to assets without owning them. Derivatives are typically used for managing financial risk or leveraging investments. The main types include:

Futures Markets: Contracts to buy or sell an asset at a predetermined price on a specific future date, traded on exchanges (e.g., commodity futures like oil or financial futures like stock indices).

Options Markets: Contracts granting the right, but not the obligation, to buy (call option) or sell (put option) an asset at a set price before or at expiration (e.g., stock options).

Swaps Markets: Agreements to exchange cash flows or liabilities over time, often between interest rates or currencies (e.g., interest rate swaps, credit default swaps).

Forwards Markets: Customised contracts to buy or sell an asset at a future date for a price agreed upon today, typically traded over-the-counter (OTC).

Securities in the derivatives markets are traded on the stock exchanges (for equity futures & options) and on other platforms as explained in this post.

Foreign Exchange Markets (Forex)

Foreign Exchange Markets (Forex) are where currencies are traded, facilitating international trade, investment, and currency conversion. Forex markets operate 24/7, with participants including banks, corporations, governments, and retail traders. They determine exchange rates based on supply and demand, influenced by economic factors, interest rates, and geopolitical events. The Foreign Exchange Management Act, 1999 (Act 42 of 1999), better known as FEMA, 1999, provides the statutory framework for the regulation of Foreign Exchange derivative contracts in India. Key segments include:

Spot Forex Market: Immediate currency exchange at the current market rate, typically settled within two business days (e.g., converting INR to USD for travel).

Forward Forex Market: Contracts to exchange currencies at a future date at a predetermined rate, used to hedge against exchange rate fluctuations (e.g., a company locking in a rate for future payments).

Forex Derivatives: Instruments like currency swaps and options, used for speculation or hedging (e.g., a currency swap to manage interest rate exposure across currencies).

Securities in the forex markets are traded on the stock exchanges and on other platforms as explained in this post.

Commodity Markets

Commodity markets are financial markets where raw materials or primary goods—known as commodities—are bought and sold. These markets serve producers, consumers, and investors, facilitating price discovery and risk management. Commodities are typically divided into hard commodities (e.g., oil, metals) and soft commodities (e.g., agricultural products like wheat, coffee). Key segments include:

Physical Commodities: The actual goods traded, such as gold, oil, or corn, often delivered upon contract completion (e.g., oil shipments to refineries).

Commodity Derivatives: Financial contracts like futures, options, and swaps based on commodity prices, used for hedging or speculation (e.g., a farmer locking in wheat prices with a futures contract).

Commodity markets are influenced by supply-demand dynamics, weather, geopolitical events, and economic conditions, making them volatile. These markets ensure price stability for producers and consumers while offering investment opportunities.

Securities in the commodities markets are traded on exchanges like Multi Commodity Exchange (MCX), National Commodity and Derivatives Exchange (NCDEX) etc.

A note on key terms used in this post

Why do Money Markets Exist?

Money markets exist in India to facilitate the short-term borrowing and lending of funds, typically with maturities of one year or less, ensuring liquidity and stability in the financial system. They serve several key purposes:

Liquidity Management: Banks generate money by lending out the deposits (savings accounts) to borrowers (corporations, individuals etc). But, as per RBI policy banks must park certain percentage as Cash Reserve Ratio (CRR) & SLR (Statutory Liquidity Ratio) to address immediate liquidity needs (such as cash withdrawals from customers). So, banks keep their reserves close to the CRR + SLR amounts. Events such as tax transfers, salary payments change their liquidity positions bringing the available reserves below the required amount. To fill this shortfall and avoid being fined by the RBI, banks tap the money markets to borrow money from other banks at the repo rate (or a number close to it as discovered in the money markets). In short, money markets allow banks, corporations, and the government to manage daily cash flows and meet short-term financial obligations efficiently, balancing the demand and supply of funds.

Short-Term Funding: They provide a platform for the government to raise funds through instruments like Treasury Bills and for businesses to address working capital needs via tools like Commercial Paper and Certificates of Deposit.

Monetary Policy Implementation: The Reserve Bank of India (RBI) uses money markets to regulate liquidity and influence interest rates through tools like repos and open market operations (OMO), supporting economic stability. Whenever banking liquidity needs adjustment, the RBI conducts OMO in the money markets to inject liquidity into the banking system. We will discuss more on this in a later section.

Safe Investment Avenue: They offer low-risk, highly liquid investment options for investors with surplus funds, such as mutual funds and financial institutions.

Economic Development: By channeling idle funds into productive uses, money markets support trade, industry, and commerce, contributing to overall economic growth.

Why do Forex Markets Exist?

Foreign Exchange (Forex) markets exist to facilitate the exchange of one currency for another, enabling global economic activities and financial stability. Their key purposes include:

International Trade: They allow businesses to convert currencies for importing/exporting goods and services (e.g., an Indian company paying a U.S. supplier in USD).

Investment Opportunities: They enable investors to diversify portfolios by accessing foreign assets, such as stocks or bonds in other countries.

Hedging Risks: Companies and individuals use Forex to protect against currency value fluctuations (e.g., locking in exchange rates with forward contracts).

Balance of Payments: They help countries manage cross-border transactions, including capital flows and remittances, maintaining economic equilibrium.

Speculation: Traders profit from currency price movements, adding liquidity and aiding price discovery.

In India, retail investors are not allowed to tap the forex markets unless they have an exposure to the forex risks, such as, import businesses requiring US dollars to purchase goods in the international markets.

Why do Swaps Markets Exist?

Swaps markets exist to facilitate the exchange of cash flows between parties, allowing them to manage financial risks, optimise funding costs, and speculate on market movements. Their key purposes include:

Risk Management: Swaps help hedge against fluctuations in interest rates, currencies, or credit events. For example, an interest rate swap lets a company convert a floating-rate loan to a fixed rate, protecting against rising rates.

Speculation: Traders use swaps to bet on market trends, like changes in interest rates or credit risk, without owning the underlying assets.

Arbitrage Opportunities: Differences in market conditions (e.g., interest rate disparities) allow parties to profit by swapping cash flows strategically.

What is a Credit Default Swap?

A Credit Default Swap (CDS) is a financial derivative contract where the buyer pays a periodic fee (like an insurance premium) to the seller in exchange for protection against the default or credit event (e.g., bankruptcy, failure to pay) of a third-party debtor, such as a corporation or government. If the debtor defaults, the seller compensates the buyer, typically by paying the face value of the debt minus any recovery amount. Essentially, it’s a tool to hedge credit risk or speculate on a debtor’s creditworthiness without owning the underlying debt. CDS are typically traded over-the-counter (OTC), meaning they are negotiated directly between parties rather than on an exchange, though some standardised CDS contracts are now cleared through central counterparties for transparency.

For example, if an investor holds bonds from Company X and fears default, they might buy a CDS from a bank. If Company X defaults, the bank pays the investor; if not, the investor keeps paying the premium.

What is an Interest Rate Swap?

An interest rate swap is a financial derivative contract where two parties agree to exchange interest rate payments—typically one party pays a fixed rate, and the other pays a floating rate, based on a notional amount. They’re used to manage or hedge interest rate exposure—without exchanging principal.

For example, Company A has a floating rate loan but prefers stability with fixed payments. Company B has a fixed rate loan but thinks rates will fall, so it prefers a floating rate. They enter an interest rate swap. After the swap agreement, Company A pays fixed % to Company B. Company B pays floating (say LIBOR, or any reference rate) + 2% to Company A.

It is important to note that each party continues to pay its actual lender, but offsets the cost by swapping interest rate payments.